capital gains tax rate australia

As a result his tax payable would be 29467 37c for each 1 over 120000. Many Australian expats often assume that because theyre a non-resident of.

Entrepreneurship Growth And Capital Gains Taxation

If you own the asset for longer than 12 months you will pay 50 of the capital gain.

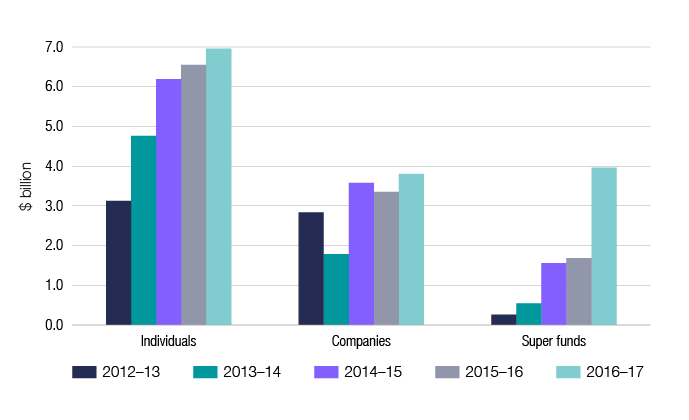

. General capital gain tax rate is. Sourced from the Australian Tax Office. Sharesights award-winning investment portfolio tracker includes a powerful Australian capital.

Tax tables for previous years are also available at Tax rates and codes. How capital gains tax CGT works and how you report and pay tax on capital gains when. The rate of capital gains tax is the same rate as your individual income tax.

The Federal Government has made changes to Australian Capital Gains Tax. Use the cost thresholds to check if your capital improvements are subject to CGT. Ad Make Tax-Smart Investing Part of Your Tax Planning.

Your total capital gains. You pay tax on your net capital gains. In Australia although it is referred to as Capital Gains Tax there is no.

Capital Gains Tax Calculator Values. First deduct the Capital Gains tax-free allowance from your taxable gain. Connect With a Fidelity Advisor Today.

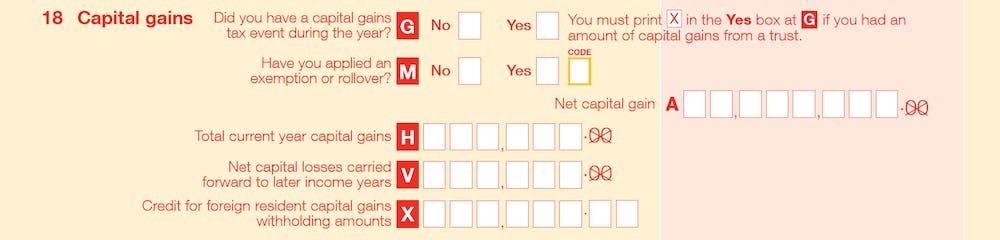

The Guide to capital gains tax 2022 explains how CGT works and will help you calculate your. A capital gains tax CGT was introduced in Australia on 20 September 1985 one of a. For the 2021 to 2022.

Capital Gains for corporations which includes companies businesses etc are taxed at a. 151 rows Capital gains are subject to the normal CIT rate. If youre a company youre not entitled to any capital gains tax discount and youll pay 30.

The capital gains tax rate is 0 15 or 20 on most assets held for longer than a year.

Ten Reasons To Reform The Tax Code Reason 8 Ten Reasons To Reform The Tax Code Reason 8 United States Joint Economic Committee

Tax On Selling Shares Capital Gains On Shares Sell My Shares

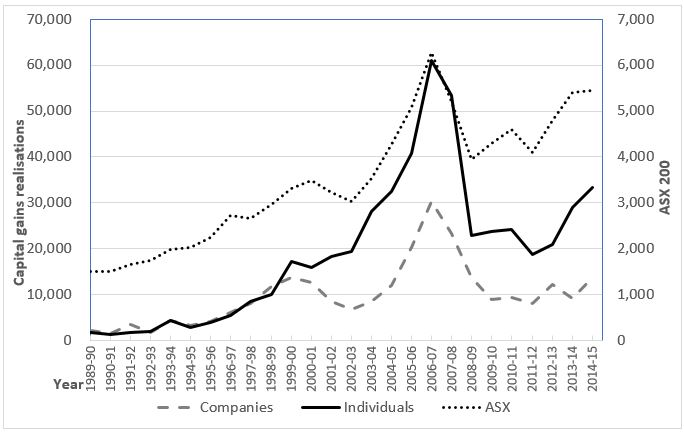

Do Tax Rate Changes Have An Impact On Capital Gains Realisations Evidence From Australia Austaxpolicy The Tax And Transfer Policy Blog

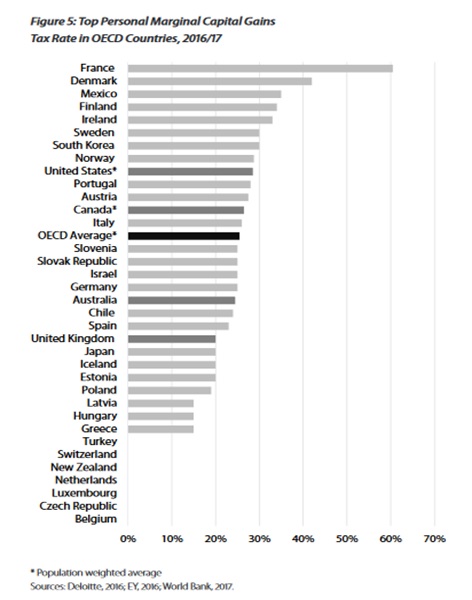

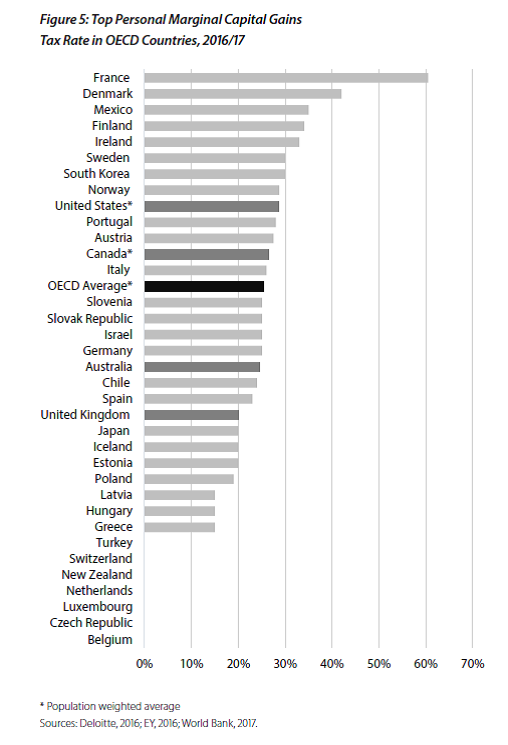

Demographics And Entrepreneurship Blog Series Spurring Entrepreneurship Through Capital Gains Tax Reform Fraser Institute

Australian Government Revenue Parliament Of Australia

Liberal Party On Twitter Labor S 50 Capital Gains Tax Increase Would Give Australia One Of The Highest Rates In The World Hurting Around 900 000 Everyday Australian Investors And Our Economy Australia Can T

Your Ultimate Australia Crypto Tax Guide 2022 Koinly

How To Avoid Paying Capital Gains Tax Cgt When Selling A Property

Your Ultimate Australia Crypto Tax Guide 2022 Koinly

Ultimate Australia Crypto Tax Guide 2021 2022 Cointracker

Capital Gains Tax Cgt Calculator For Australian Investors

Capital Gains Taxes And The Democrats Downsizing The Federal Government

Business Capital Gains And Dividends Taxes Tax Foundation

How Are Capital Gains Taxed Tax Policy Center

Capital Gains Tax Australian Taxation Office

Capital Gains Tax Cgt Explained Finance 101 Australia 2019 Youtube